THE SOUTHEAST

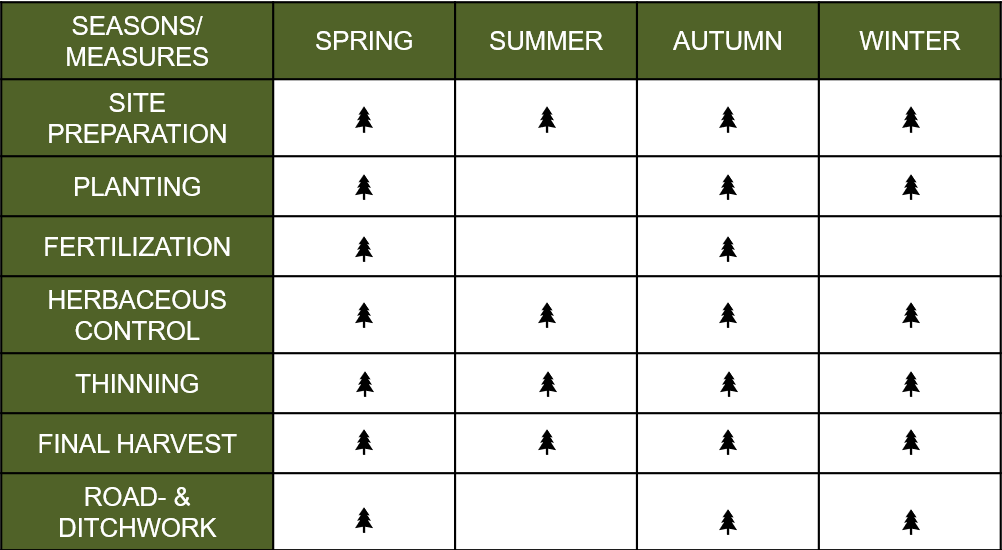

Since the 1950s, forestry in the Southeast region of the USA has been flourishing. Approximately 70 years ago, there were less than 2 million acres of pine plantations in the Southeast - today there are more than 32 million acres. The decisive factor for this development is the transfer of scientific findings to silvicultural processes and measures. The successful cooperation of industry, forest owners, forestry authorities and scientific institutions, paired with excellent climatic conditions, has been trend-setting for research in the Southeast to this day. Scientific research has been carried out since the 1950s in the areas of seed production, improvement of genetic material, land preparation, control of competitive vegetation and the use of fertilizers and pesticides. The knowledge gained there is the fundamental driving force behind the success of the plantation economy in the Southeast USA.